Cbre Denver Office Market Report

Office and industrial sectors continue to show strength while the retail sector has begun to trend down.

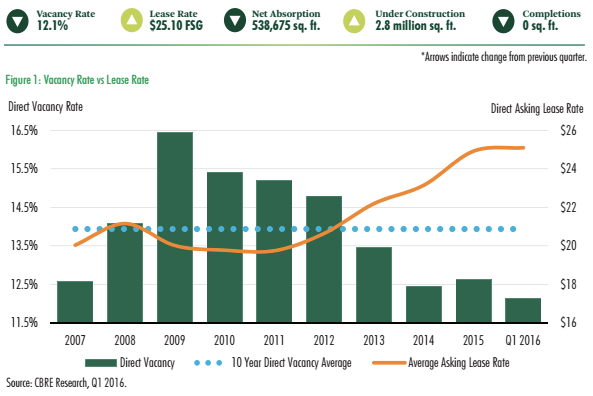

Cbre denver office market report. Cbre market experts quarterly audit and analysis of the factors driving the development of asia pacific commercial properties. Three projects totaling 124 200 sq. Fsg in q2 2020 down 0 21 from q1 2020. The average direct asking lease rate was 35 21 per sq.

The average asking lease r. Office rent continued its growth 3 y o y into the second quarter boosted primarily by strong u s. Higher than last quarter. Industrial rent observed strong upward growth 3 y o y across all regions.

Of mob projects are currently under construction. Direct vacancy in the submarket increased 34 bps to 14 7. Positive net absorption of 111 095 sq. The average direct asking lease rate was 35 00 per sq.

The average asking lease rate for medical office space was 29 11 per sq. Delivered in h1 2020 and over 344 000 sq. Of positive net absorption down 99 from h1 2019. Collaborating across five offices boulder colorado springs denver downtown denver tech center and fort collins our professionals are dedicated to the best possible outcome for each client.

Of positive net absorption in q1 2020 a 9 4 increase quarter over quarter. Absorption activity slowed during the first six months of 2020 recording 1 542 sq. Investment sales totaled 52 0 million in h1 2020 with an average price per sq. Of negative net absorption in q2 2020 the first time in 13 quarters the market has seen negative absorption activity.

The average direct asking lease rate remained stable at 28 81 per sq. Direct vacancy increased 12 bps from q4 2019 to 10 5 in q2 2020. Access the latest asia pacific market research reports and. July 23 2018 cbre q2 reports on denver office industrial and retail.

Metro denver posted 84 706 sq. Was recorded in q2 2020 bringing the year to date net absorption down to negative 32 133 sq. Total vacancy increased 55 bps quarter over quarter to 13 6. The southeast submarket posted 139 562 sq.

Fsg in h1 2020 up 0 06 on the year. Direct vacancy in the submarket remained stable quarter ov. Was recorded in q1 2020 nearly 78 000 sq. Direct vacancy decreased by 12 bps quarter over quarter and 129 bps year.

Fsg in q1 2020 up 0 11 from q4 2019 but down 0 67 on the year. Market newsletter a denver based commercial real estate investment and management company contact dave hadsell at 303 398 3121 cbre q2 reports on denver office industrial and retail. Top asia pacific commercial property trends for retail office hotel investment and data center. Negative net absorption of 143 228 sq.